Not figured out by the market rate of interest, is chosen by the central banks. Can not be used in identifying present worth. Can be used in figuring out the present worth of the future capital. Based on the marketplace and concentrating on the Loan provider's point of View Focusing on the Financier's point of View Affected by Need and supply in supply in the economy. Not Affected by Demand and supply in supply in the economy. After examining the above info, we can state that Discount rate Rate vs Interest Rate are 2 different concepts. A discount rate is a wider idea of Financing which is having multi-definitions and multi-usage.

In some cases, you need to pay to borrow money then it is a direct monetary expense. In other cases, when you invest cash in an investment, and the invested cash can not be used in anything else, then there is an opportunity expense. Discount Rate Rates vs Rates Of Interest both belong to the cost of cash but in a various method. If you have an interest in Financing and want to operate in the Financial Sector in the future, then you need to know the distinction between Rate of interest and Discount rate. This has a been a guide to the leading difference between Discount rate Rate vs Rates Of Interest.

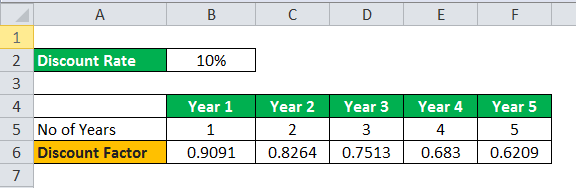

In finance, the discount rate has 2 important meanings. Initially, a discount rate is a part of the calculation of present worth when doing a discounted money circulation analysis, and 2nd, the discount rate is the rate of interest the Federal Reserve charges on loans offered to banks through the Fed's discount window loan procedure - How long can you finance a camper. The very first definition of the discount rate is an important component of the discounted capital computation, an equation that figures out just how much a series of future cash flows is worth as a single swelling amount worth today. For financiers, this computation can be an effective tool for valuing josiah browning services or other investments with predictable earnings and capital.

The business is steady, consistent, and predictable. This company, comparable to lots of blue chip stocks, is a prime candidate for a reduced cash circulation analysis. If we can forecast the business's revenues out into the future, we can use the affordable capital to approximate what that company's evaluation must be today. How to finance a home addition. Regrettably, this process is not as easy as simply adding up the cash circulation numbers and coming to a value. That's where the discount rate comes into the image. Cash flow tomorrow is not worth as much as https://juliusozja513.edublogs.org/2022/04/28/some-known-factual-statements-about-how-long-can-you-finance-a-used-car/ it is today. We can thank inflation for that truth.

Second, there's unpredictability in any forecast of the future. We simply don't mywfg online know what will take place, consisting of an unexpected reduction in a business's profits. Money today has no such uncertainty; it is what it is. Because money flow in the future brings a risk that money today does not, we should discount future cash circulation to compensate us for the danger we take in waiting to get it. These two factors-- the time value of cash and uncertainty threat-- combine to form the theoretical basis for the discount rate. A higher discount rate indicates higher uncertainty, the lower the present worth of our future capital.