Department of Veterans Affairs' VA loan likewise comes with a renovation choice that assists veterans enter a fixer-upper and pay for certain Hop over to this website kinds of improvementswith no cash down at all! However when you purchase and renovate a house with absolutely no cash down and things alter in the real estate market, you could end up owing more than the marketplace worth of your homeyikes! Also, VA loans include a funding fee that's 1 (what does it mean to finance something).

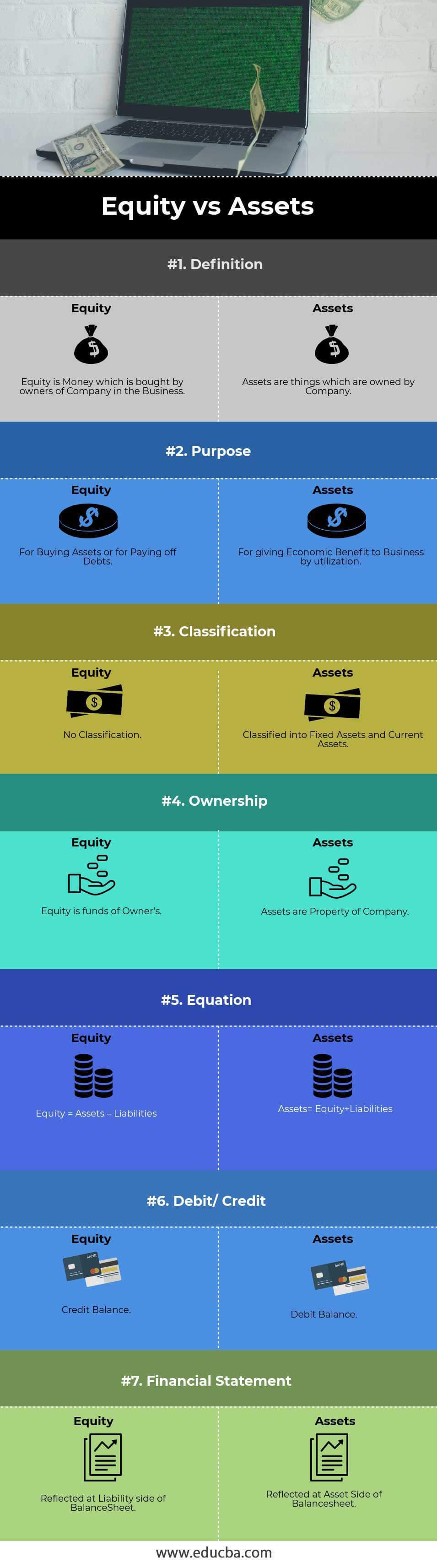

6% of your total loan amount.6 No thanks. You might become aware of this choice after you acquire a home and have some equity in it (equity is how much the home deserves, minus how much financial obligation you owe on it). Essentially, what you 'd be doing here is obtaining against your home to release up some money for restorations.

Picture how painful it will be to repay all that you already bought the houseplus interest! If you can't manage to make at least a 1020% deposit on your fixer-upper, you're not in a perfect location to manage all the costs that include homeownershipespecially restorations. Do not let renovation mortgages lure you down a financial hole.

If you desire to purchase a fixer-upper in a fantastic area, a professional property representative who understands the area will have the ability to help you select the one that's right for you. For a fast and simple method to discover among the very best representatives in your location, attempt our program.

If you're believing about buying a fixer-upper house, you may wish to keep the following ideas in mind. While a home evaluation will cost you a couple hundred dollars, it's nonnegotiable if you wish to purchase a fixer-upper. A certified house inspector will carry out a comprehensive investigation of your house and provide you with a report that details all the repairs it will require.

A house examination assists you avoid undesirable surprises in addition to spending plan for and focus on tasks. A house assessment is a necessary part of any home purchase, however particularly with a fixer-upper. When you purchase a fixer-upper home, you wish to ensure you can easily afford to turn it into the space you want.

Do some online research and get quotes from contractors. Although you will not be able to concern a specific expense for everything, you'll have the ability to find out a ballpark that allows you to budget accordingly and decide whether the financial investment is beneficial. There are some remodellings that may need permits.

How How To Finance A Rental Property can Save You Time, Stress, and Money.

Depending on how intricate your task is, you might need to provide in-depth plans. There's no rejecting that Do It Yourself restorations will conserve you a lots of money as specialists can be expensive, particularly if you use them for each job. If you come in handy (or have some friends or member of the family who are), determine which projects you can remodel yourself.

There are two excellent financing options that can help you spend for the cost of your home in addition to the remodellings. With the Federal Housing Administration (FHA) 203( k) rehabilitation loan or Fannie Mae HomeStyle Renovation Home loan, you'll be able to buy your home and put a reserve in escrow to fund restorations.

The entire point of purchasing a home that needs work is getting a bargain on it. Make an offer that strikes a balance in between a bargain and the cost of needed repairs. With any deal, you must consist of contingencies. Contingencies are exceptions that allow you to back out of a purchase if something turns up.

If an assessment discovers a major issue or the home assesses lower than what you used, you can back out. You ought to likewise be able to negotiate a selling cost. If the house you have an interest in has several flaws, you might have more bargaining leverage. Deal with a representative to make a wise offer and manage any counteroffers.

With cable television shows highlighting both the advantages and the challenges of purchasing and financing a fixer-upper house, some potential home purchasers would rather flee from the whole idea while others are more open up to handling such a difficult job. Although there are numerous obstacles you may encounter along the way, you might find that remodeling your brand-new home can be very satisfying once the restoration is total.

You're prepared to commit the time to complete all the essential improvement. The house worth will surpass the restoration expense. You're patient and can handle unintended missteps with ease. The amount you 'd receive for selling your existing home isn't adequate to buy a move-in prepared home in your perfect neighborhood.

When you determine whether purchasing and funding a fixer-upper is right for you, take these suggestions into factor to consider as you begin the process. 1. Similar to discovering a home loan business or a realtor, you need to speak with multiple contractors before you hire one. Have them stroll through your house and see if they notice any required restorations that you didn't catch already.

The Main Principles Of Which Caribbean Nation Is An International Finance Center

You might discover that some houses aren't worth it. 2. When renovating a home, problems frequently develop that neither you nor your contractor could foresee. Foundation issues. Out-of-date electrical wiring. Load-bearing walls in requirement of support. Rusted pipes. For these factors, you must prepare to set money aside for dealing with any of these disadvantages before you set your remodelling bluegreen timeshare secrets spending plan.

If a home listing is well under your budget plan, you might be inclined to think about the property since you'll believe you have more cash to put into https://penzu.com/p/e7b7e431 it. But pay attention to the quantity of work that truly requires to get done and determine if you're going to get back the cash you spend.

The best method to do this is ask your realtor and look at what other homes in the area are selling for. 4. This type of mortgage is created particularly for house buyers who buy fixer-uppers. Obtaining such a loan would help you pay not only for your brand-new home but also for the remodellings.

Given that renovating a fixer-upper is a substantial undertaking, make sure that you have a strategy in location with a little wiggle room. Due to unpredicted expenses, your remodelling schedule might have to be set back numerous times, and that might prove expensive. 6. Depending on how much improvement work your brand-new house requires, you may want to think of remaining elsewhere for some time up until the job is done.

You've seen it on HGTV shows like Residential or commercial property Brothers or Fixer Upperexperts take an out-of-date home and make it into the buyer's dream homeall at a fraction of what it costs to purchase new - how to get a job in finance. But is it possible to live out your HGTV dreams in truth? "Absolutely," states Chris Busching, remodelling loan specialist with TowneBank Home mortgage in Virginia Beach, who has more than 20 years of experience concentrating on renovation loans.